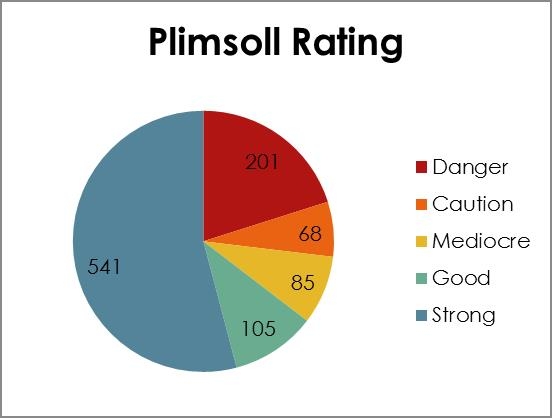

A study into the financial health of UK's largest 1000 security companies has revealed as many as 201 need an urgent survival plan, either from an injection of capital, a radical cost reduction scheme or financial restructuring if they’re to continue to trade,.

Plimsoll’s latest research has investigated the overall financial performance of each of the UK’s leading security companies and scored each on their financial health. Each company has been given a rating of either strong, good mediocre, caution or danger.

David Pattison, Plimsoll’s Senior Analyst, said: “We tested this method of analysis on a study of 351 previously failed companies, including all the latest retail failures, and this showed 320 had a caution or danger rating up to two years prior to their demise.

“This proves our method of analysis can identify the key characteristics of a failing company. If failures are predictable, and if enough warning can be given, the management has time to get a survival plan in place to save the company.

“It is clear from this study the Security market is going through a period of great change and the market is highly competitive. These 201 companies rated as danger are clearly operating under financial pressure an

d many risk being forced out of the market.”

|

Plimsoll Rating |

Number of Companies |

|

Strong |

541 |

|

Good |

105 |

|

Mediocre |

85 |

|

Caution |

68 |

|

Danger |

201 |

Typically a failing company will show the following characteristics:

- · A fall in sales relative to investment

- · A decline in profitability relative to investment

- · An increase in total debts

- · A fall in shareholder equity

- · An increase in the exposure of creditors

The study gives a detailed financial analysis of each of the 1000 companies to reveal where each one is strong or weak, showing clearly the difference between a strong and a danger company.

Danger companies in general:

- · On average these companies are losing -2p on every £1 they sell

- · 126 are making a loss

- · Many have high debts

Strong companies in general:

- · Make 3% margins per year

- · Are sitting on healthy cash piles

- · Most are operating completely debt free

Pattison added: “The 541companies rated as strong have a real commercial advantage and they are proof the fundamental market is healthy.”

For more information on the Security report or any of Plimsoll’s titles please contact Chris Glancey on 01642 626 419 or alternatively email This email address is being protected from spambots. You need JavaScript enabled to view it. Readers of this article are entitled to a £50 discount off this report by calling 01642 626419 and quoting reference PR/SV50.